Paymongo - A Filipino Startup in Silicon Valley

/The Paymongo guys: Luis, Jaime, Francis and Edwin

When buying online in the Philippines, the common practice (with the exception of bank transfers) among social media sellers on Facebook or Instagram is to text their bank account number to the buyers. The latter would then (1) line up in the bank, (2) pay the amount, (3) take a photo of the deposit slip, (4) send the photo to the seller either by text, Whatsapp, or Viber, (5) seller confirms receipt of photo; and (6) only then will the buyer deliver the product. One could conclude by the enumeration of the steps alone that it is a tedious, cumbersome process.

The epiphany of the pain point gave rise to a light bulb solution: Our startup Paymongo makes online payments easier and faster without having to go through a cumbersome payment process.

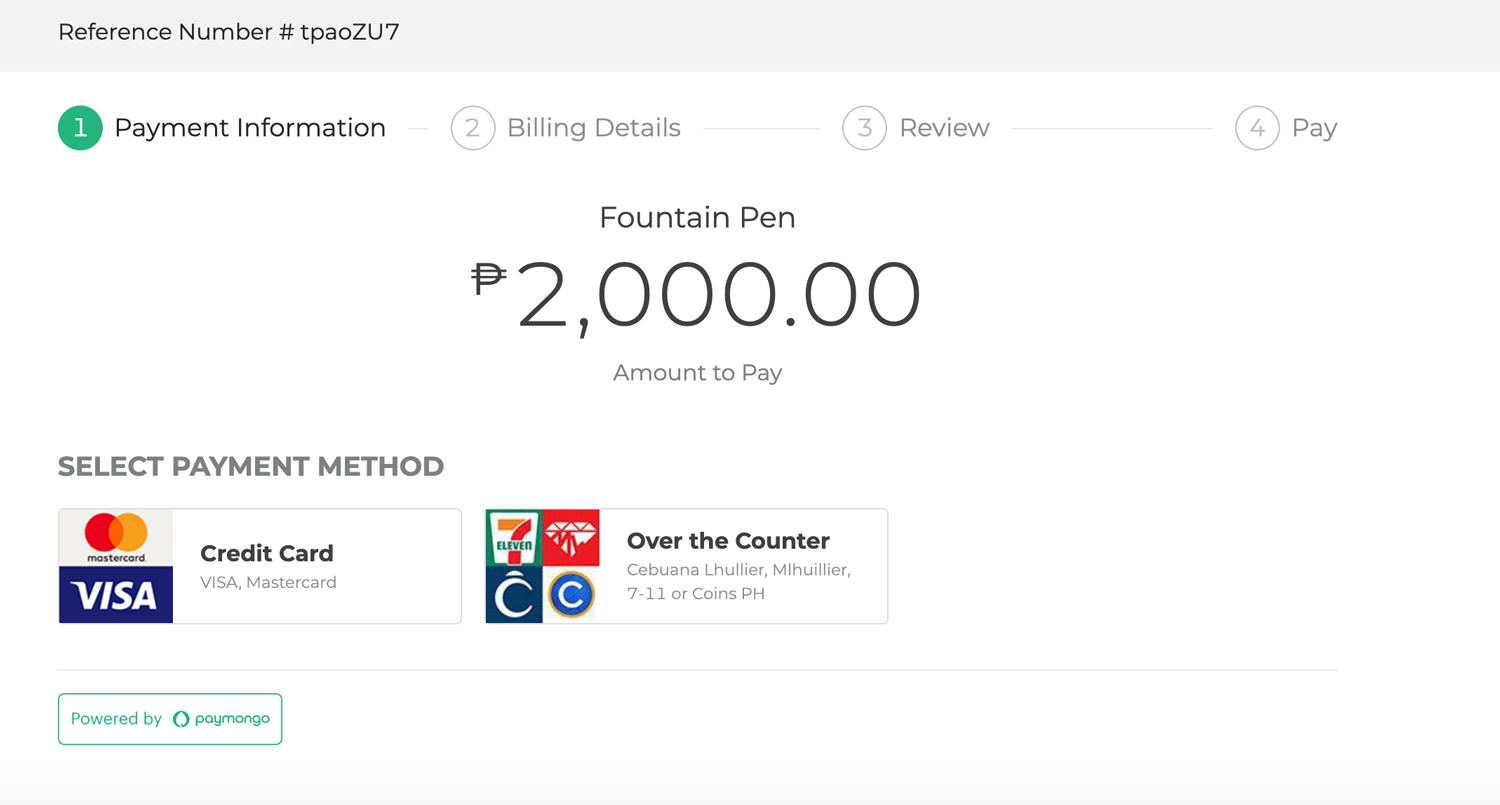

In addition, PayMongo aggregates different kinds of payment methods: credit cards; E-wallets; bank transfers; and over-the-counter payments (7-Eleven, pawnshop payment centers) so online sellers can offer their buyers to select their preferred choice of payment, and at their convenience.

So how is this done? Instead of sending the bank account number, the online seller would send a shareable “Paymongo Link” to the buyer; the buyer clicks on the link, and payment option menu immediately appears with the details of the purchase enumerated; buyer just decides to choose the payment option. If the credit card option is chosen, he pays online; if the over-the-counter option is chosen, he goes to the payment center; the payment is received by the seller in real time. No more photos of deposit slips, no more waiting for confirmation, no more wondering if the payment is received; the online seller is informed of the payment as soon as payment is made.

With this, PayMongo has made online commerce for social media sellers, as well as small and medium enterprises, more convenient and more frequent, thus enabling the growth of the internet economy at a much faster rate,

PayMongo

PayMongo was started last March by four men: Francis Plaza, one of the very few MIT Filipino graduates who was on full scholarship; Jaime Hing II, a software engineer; Luis Sia, a business entrepreneur; and myself, a former Cabinet member and Presidential Spokesperson to President Benigno S. Aquino III.

Francis and Jaime have known each other for several years having worked together in a logistics firm and developed logistics software. Luis and Francis met each other in college and in some computer science organizations. During my government stint, I was also the Chairman of the Open Data Philippines Task Force with the mandate of putting government data online in an open, shareable format. I met Francis in December 2016 and, together with two other friends, we set up a behavioral analytics startup.

PayMongo brought all four of us together, and sometime in March, Francis suggested we apply to the summer batch program of Y Combinator (“YC”), a Silicon Valley seed incubator that is known to be the best seed incubator in the world. Airbnb, Dropbox, Reddit, Brex, and Stripe, among others, were incubated by YC, from where a number of what would eventually turn out to be billion-dollar valued companies or unicorns,

Francis, Edwin, Luis and Jaime

After submitting our application, the next step was a 10-minute video interview to assess the application. We were interviewed by Tom Brady, a YC partner and the first employee of Yahoo in 1997. Essentially, the interview was a way of evaluating whether the team had good chemistry and how knowledgeable the team was on the pain point and their product. We passed the preliminary interview and were told to go to Mountain View in the U.S. in May for our final interview.

The weeks preparatory to Mountain View were a period of getting inputs and tips from previous YC graduates on how to pass the final interview. Shark Tank was the closest analogy, and the team prepared hard, doing research, anticipating possible questions, and but for the grace of God, we went.

On the day of our interview, May 30, we were with numerous startup-applicants from all over the U.S. and the world, waiting for their turn for the final interview. Our turn came and we were grilled for 10 minutes and this time, we were grilled by five people on the panel. Their questions were tougher and more varied, but essentially, were about assessing whether the four of us would have the right chemistry since the process of working in a startup would entail potential debates and arguments. They needed to know if we would be able to withstand the rigors of a new company.

“Did we get investments? The short answer is yes, but the greater impact for us was having well-known Silicon Valley firms investing in PayMongo.”

After the interview which ended around 4 p.m., we were told to wait for a phone call if we were accepted, or an email if we were rejected. At around 8 p.m., Francis received an email from one of the panelists, and we thought we were rejected. Francis felt dejected from seeing the email, but it turned out the panelist wanted some more clarification. And so, we waited, and finally at 10 p.m., Francis received a call that we had been accepted! That night, it dawned on us that we would be the first Filipino fintech startup ever to be accepted by YC.

And so, we went through the three-month program. We were part of Group 4 with five other startups. Every other week, we would meet with our mentors and discuss the progress of our development. They asked difficult questions and with a specific instruction for us always to tell the true status of our progress. On other weeks, we could request for time with specific mentors to discuss our peculiar problems or questions.

It was a time of discovery and learning and adopting the mindset of a startup company. And one of the most memorable lines we remembered was given by a mentor when we were hesitant to put our product online, and it was: “JUST LAUNCH.” After all, we would not know the bugs and how to fix them unless we put the product out for people to give us user feedback!

On the last month of our program, we prepared for what is called DEMO DAY, when each startup would present its product in two minutes before a crowd of more than a thousand investors, who were either venture capital firms, angel investors, or YC alumni who were interested in investing in fellow YC startups.

Since there were over 180 startups presenting, DEMO DAY was done in two days, and we presented on the second day. Francis presented our two-minute pitch while the three of us stood in the stage with him. While one investor had previously called the Philippines a “black hole,” our presentation was received very well and got a lot of interest from a number of investors. After the presentation, we felt a great burden was lifted and what was a three-month intensive program had come to a good end.

Did we get investments? The short answer is yes, but the greater impact for us was having well-known Silicon Valley firms investing in PayMongo. Some of these investors are Peter Thiel, the PayPal co-founder and the first investor of Facebook; Justin Mateen, the co-founder of Tinder, Soma Capital, Global Founders Capital, Stripe which was reported in the news as presently valued at US$35B; as well as other investors in Silicon Valley and the Philippines. From an original amount of US$1.5M that we wanted to raise, we were able to secure US$2.7M for our seed round. This is the highest amount ever raised by any Filipino startup company to date.

Paymongo payment platform

It has been an exhilarating ride. When we launched the product last June, we only had 10 merchants who decided to try us out. In a span of almost four months, we now have over 1,400 merchants who have signed up with us and we continue to grow.

Where do we go from here? We will continue to grow our merchant base, cater to our small and medium enterprises that now have an opportunity to engage in online commerce, and encourage more Filipinos to sell their products online, especially now that PayMongo affords them the certainty of getting paid for their products or services. In addition, we intend to expand to other Southeast Asian countries, and some foreign firms have asked us to set up in their respective countries.

“Building a modern payments infrastructure provides a backbone for new and existing players to thrive in the rapidly evolving digital economy,” said 26-year-old CEO Francis Plaza. “We’re building the highway that other founders and companies like us can use so that they can focus on building great products and scale massively,” he added.

In a small way, we have proved that Filipino talent can compete with the best and brightest. It does not matter if we are from a Third World country because good talent is universally recognized, and when a product has proved itself, people will come and invest.

More importantly, we have opened the eyes of Silicon Valley investors to look at the Philippines and the many talented startups there. We have proved that Filipinos can compete even in such a highly technical environment like Silicon Valley. PayMongo is proud to be Filipino! We will not let our country down.

Edwin Lacierda was the Presidential Spokesperson for President Benigno Aquino III.